Why INPODE?

1. Some uncomfortable truths about the money management business.

The question that every person who is saving money for retirement or building an estate should be asking is the following: Can I invest on my own, without paying money management firms to do it for me? The answer is yes! Anyone may buy the shares of great companies or, if you do not want to analyze companies, follow Warren Buffett and Charlie Munger’s advice, buy ETFs and/or index funds. If you buy at the right time, minimize portfolio expenses and are patient you will almost certainly succeed in slightly under performing the market average and in the process do better than most professionals.

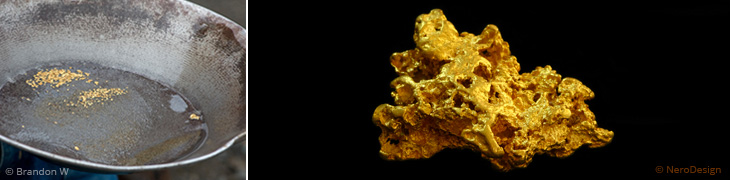

However, before you make up your mind, let us tell you a story about panning for gold in Bonanza Creek in the Klondike in the Yukon. Every Canadian school child has heard the story of George Washington Carmack, his brother-in-law Skookum Jim and nephew Tagish Dawson Charlie. They discovered large quantities of alluvial gold in the Yukon’s Klondike Creek on August 16, 1896 and launched the Klondike gold rush. We too panned for gold in Klondike Creek but much too late (2002) and the tools we used were small sieves rented to us by a small company in the business of entertaining tourists. We did find some gold dust worth a few cents. So what is the connection with you and INPODE?

To be a successful stock market investor you need the right tools, the right timing, and the right frame of mind. In the Klondike we did not own a large dredge and a bulldozer or two. As a result, we discovered almost nothing because we were competing against well-equipped competitors. Things are different for us in the stock market. For tools INPODE uses very large databases to sift through large numbers of listed companies in 22 stock markets around the world looking for the “gold nuggets” of quality companies hiding in the waters and sands of “Global Stock Markets Creek”. These companies have records of uninterrupted dividend payments as well as other qualities that make us as confident as one can be that these firms will continue to generate growing dividends. INPODE portfolios are not invested in each company equally. Instead, each stock’s weight in any INPODE portfolio depends on how the stock’s returns move against every other return in the portfolio. This is how we avoid putting all our eggs in one basket. Note that the main task of INPODE portfolios is to maximize your dividend income while preserving and growing your capital. This brings us back to the issues of timing and the right frame of mind. Warren Buffett often talks about Mr. Market, a metaphor used by Ben Graham, his finance professor at Columbia Business School. Here it is from Ben Graham himself:

Imagine that in some private business you own a small share that cost you $1,000. One of your partners, named Mr. Market, is very obliging indeed. Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or sell you an additional interest on that basis. Sometimes his idea of value appears plausible and justified by business developments and prospects as you know them. Often, on the other hand, Mr. Market lets his enthusiasm or his fears run away with him, and the value he proposes seems to you a little short of silly.

If you are a prudent investor or a sensible businessman, will you let Mr. Market’s daily communication determine your view of the value of a $1,000 interest in the enterprise? Only, in case you agree with him, or in case you want to trade with him. You may be happy to sell out to him when he quotes you a ridiculously high price, and equally happy to buy from him when his price is low…price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies.

Ben Graham, The Intelligent Investor Chapter 8, pp. 108-109

We argue that INPODE has the tools and the right frame of mind to meet your requirement for a fairly stable portfolio that meets your needs for reliable dividend income while preserving your capital. As for timing, for buying and selling, we are not cleverer than anyone. INPODE software, however, removes emotion and is designed to tell us when we should buy quality companies at fair prices (if you want to read about what academic research has to say about these issues here is a good starting point: click to download the paper). In sum, we think that INPODE’s software can do it better for you than you can do on your own. Here is an excellent academic paper on the reasons why trading is a poor investing strategy: click to download the paper.

2. INPODE portfolios have “enough” diversification but are not over diversified.

INPODE portfolios are focused on relatively few stocks. We have done research on the topic of optimal portfolio size and we find that owning 10-20 different stocks serve investors well in most markets.

3. INPODE portfolios are fairly low cost because they are not large and can be monitored relatively easily.

4. INPODE focuses on cash dividends through thick and thin.

We do not try to predict earnings, growth in revenue and in dividends. Much academic research has shown that these variables are unpredictable (click here to read about a wonderful paper by I.M.D. Little on “higgledy piggledy” growth). Our goal in our universe of companies is simply to find those that meet our criteria of quality and pay dividends consistently and unfailingly.