Philosophy

Here are the cornerstones of our investing philosophy:

Capital preservation with an adequate rate of return

Focus on dividend-paying stocks in well-managed companies to minimize the possibility of earning lower than average returns

Invest for the very long term in quality companies

Low portfolio turnover to minimize the costs of ownership

We are risk averse. INPODE take their fiduciary responsibility to you very seriously. We define risk as Warren Buffett’s long-term friend and alter-ego Charlie Munger does “as the chance of suffering a permanent loss of capital as well as earning an inadequate return on capital invested”. The cash dividends from “dividend emperor” companies (those with a 15 year plus record of uninterrupted dividend payments) are the cornerstone of the preservation of capital. We avoid certain industry sectors where the probability of capital impairment (i.e. total loss of capital) exists. The algorithm we use to construct INPODE portfolios is designed to minimize the variability of cash returns. In light of Daniel Kahneman‘s book Thinking, Fast and Slow, our approach removes some of the human biases of overconfidence, and hindsight bias. We do our best to inoculate the portfolios we build against “regret”, which is the pain suffered when we lose. Our dividend-centered approach is designed to reassure clients of our Portfolio Manager (see Where can you buy INPODE Portfolios?) that they should ignore the inevitable ups and downs of the market. Put another way, we sell “peace of mind”.

INPODE portfolios are invested, for the most part, in equities. Under the right conditions, the OSC-accredited portfolio manager with whom INPODE works may include fixed income securities in certain portfolios. We do not believe that we can predict a company’s future performance. As a result, we focus on three variables: quality of the business reflected in uninterrupted dividend payments, ethical management and buying shares at a low price. We pick quality companies run by ethical managers whose shares we can buy as cheaply as possible depending upon current market conditions. As we explain in the Our Investing Approach section, we follow a three step approach in picking these companies. A typical INPODE portfolio contains the stocks of 10-20 companies.

We believe, and research shows, that over long periods of time equities provide the best protection against fluctuations in the economy, specifically the business cycle, inflation and technological obsolescence. We believe that common stocks of brand name and ethically run firms with enough market power to raise prices offer the best protection against fluctuations in the economy. The companies in INPODE’s database are “tried and true” rather than “bold and new” to borrow from the title of Jeremy Siegel’s book The Future for Investors: Why the Tried and the True Triumph Over the Bold and the New. Academic research shows that, in the race for investment performance, the turtle beats the hare. The companies that pay steadily growing dividends produce higher and more dependable returns over time. To guard against both kinds of “Munger risk”, the companies in the INPODE database have paid dividends for at least 15 years, including during the recent trial by fire in the Great Recession (2007-2009). These firms operate successful businesses that we understand.

Stock prices go up and down. But, the stocks in INPODE portfolios have typically paid dividends of between 1.5% and 9% per year through thick and thin for 15-25 years or longer. Note that these percentage returns are dividend cash returns only; capital gains and losses add to or subtract from these returns. As long as you keep your INPODE portfolio whole, you will keep receiving its dividends. We expect these dividends to finance part of your retirement. While focusing on dividends, we also recognize the need to protect your capital and therefore INPODE portfolios are designed to reduce the risk of capital impairment by avoiding risky companies even if they pay large dividends.

Depending on the time horizon for making withdrawals from your portfolio, you do not need to worry about the fluctuations in the stock market because you will receive steady quarterly dividends from companies that have paid these dividends for at least 15 years. Two quotes from Ben Graham, Warren Buffett’s Columbia Business School professor, support this viewpoint: “An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” And, “In the short term, the stock market behaves like a voting machine, but in the long term it acts like a weighing machine (i.e., its true value will in the long run be reflected in its stock price)”.

We also recognize that everyone suffers from behavioral biases that work against his/her long term investing interests. Research shows that many investors are spooked by price declines even when they result from external events that have nothing to do with the firm’s management or its future prospects. Following Warren Buffett’s approach, we consider ourselves partners in the firms where we invest our money. We are not casual passers-by interested only in a quick gain. The stocks in INPODE portfolios are those of stable, dividend-paying companies that have been in business a long time and will be around for many years to come.

To minimize portfolio costs, INPODE portfolios favor low turnover which reduces trading costs. Research shows that minimizing the costs of investing is one of the most important factors in obtaining the highest performance over time.

In order to minimize the stress that market fluctuations might cause some investors, INPODE’s database contains only companies that have paid steady and reliable dividends for a minimum of 15 years. The inevitable ups and downs of the stock market and stock prices do not worry us because we know that the managers of the companies selected for INPODE portfolios are competent and will pay a regular dividend regardless of the level of the stock price. In fact, just like Warren Buffett, we look upon stock market drops as opportunities for buying more shares at a favorable price. Buffett humorously says that when the market is down “he feels like a mosquito in a nudist camp”. So do we!

To summarize: The portfolios designed by Investment Portfolio Design Ltd’s software from its proprietary database, are composed mostly of the equity of companies that pay dividends through good and bad markets. INPODE portfolios minimize the chance of earning lower than average returns as much as possible. This is often referred to as “Munger risk”. We keep investing costs low by minimizing turnover. INPODE will design a portfolio that matches your attitude towards risk.

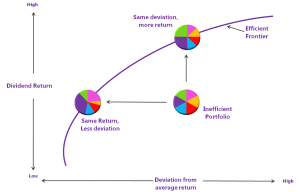

The diagram below depicts the risk-return choices investors face: higher (lower) return, more (less) deviation from average return; investors should pick a portfolio on the efficient frontier rather than one inside it.

Efficient Frontier