Approach

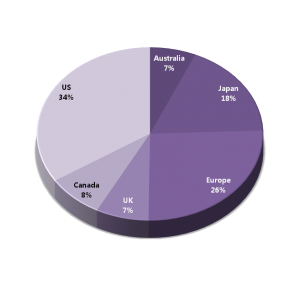

We invest the old-fashioned way in successful businesses that have paid shareholders dividends from earnings for very long periods of time, through booms and busts, including during the recent Great Recession (2007-2009). Nothing is guaranteed in the investing world, including the repayment of government debt. We believe, however, that companies which attract loyal customers build stable businesses. As a result, these companies have paid regular dividends for at least fifteen years or longer, including during the world-wide 2007-2009 economic collapse. They offer their shareholders the best guarantee of preserving capital and earning reasonable yearly returns. The compounding of these cash returns over time provides the best chance of building a substantial nest egg for retirement or for bequests to the next generation. We refer to the companies in INPODE portfolios as “dividend emperors”. These companies are located in many developed countries. We focus on Canada, the United States, and selected European countries, Japan, Singapore, South Korea, Australia and New Zealand. Here is the international breakdown by areas of the world of the dividend emperor companies in the INPODE database:

Our approach is summed up by our slogan “more income, less volatility”. We focus on avoiding a permanent loss of capital, as well as earning an adequate rate of return. We also focus on quality and on the integrity of management and take seriously Warren Buffett’s oft repeated quote,

Our approach is summed up by our slogan “more income, less volatility”. We focus on avoiding a permanent loss of capital, as well as earning an adequate rate of return. We also focus on quality and on the integrity of management and take seriously Warren Buffett’s oft repeated quote,

I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.

Warren Buffett

Our ultimate goal is to buy quality companies at a fair price and to earn reliable dividends. We do not chase dividend yields for their own sake. Indeed, we do not invest in certain sectors, despite their high dividend yields, in order to avoid the risk of losing capital.

We follow a 3-step approach:

1. Quantitative screening and portfolio optimization

Because much academic research shows that future performance cannot be predicted, we concentrate on the generation of cash dividends for our clients. If a company “walks the talk” by generating cash for dividends we may consider it for our Dream Team. We use value investing filters to screen a large universe of companies in each of our selected markets to find firms that meet our quality criteria. We call these companies “dividend emperors”, after the Antarctic penguin that inspired our company. The main point these companies have in common is that they have paid uninterrupted dividends for at least 15 years even during major crises. We remember Warren Buffett’s two rules:

Rule Number 1: Never lose money

Rule Number 2: Never forget Rule Number 1

Warren Buffett

and thus refuse to invest in industries where the probability of capital impairment is too high, even in cases where these firms currently pay high dividends. By avoiding certain industries, we sidestep the first type of Munger risk. For example, in the decade leading to 2008, although the financial numbers for some companies appeared very healthy, some of their constituent businesses were laying the seeds of their collapse in 2008. By avoiding the industries prone to misbehavior, we avoid the risk of a permanent loss of capital from which we cannot recover.

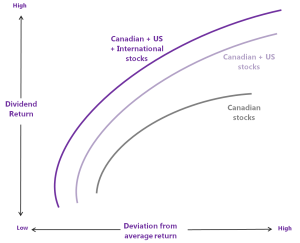

We review our INPODE database at least once a year. To build diversified portfolios, we use a mathematical optimization technique that tells us how much we should invest in each company, in order to earn the portfolio return our client needs, while keeping potential risk at bay. An INPODE portfolio is not simply an aggregation of stocks. Instead, it is calculated to take into account the individual movements in each return against all the other returns. Remember that we sell peace of mind. These portfolios can be focused exclusively on Canada, or any other country in our database. We have built portfolios concentrated on Canada, Canada-US, Canada-US and other countries in our database.

Below is a diagram showing the benefits of the wider diversification beyond domestic stocks that INPODE is able to offer in its portfolios using INPODE’s software. Note that the broadest range of choices helps improve your risk-return tradeoffs: For the same level of risk, the portfolios located on the Canadian + US + International Stocks Efficient Frontier yield a higher return than the Canadian + US stock universe or the solely Canadian portfolio; or conversely, for a given return, the stocks on the Canadian + US + International Stocks Efficient Frontier expose your portfolio to the lowest risk. Until recently, calculating efficient portfolios from such large databases required a super computer and a staff of very competent mathematicians/programmers. These calculations can now be performed by a small group of highly-trained professionals such as the group that founded INPODE.

2. Qualitative work on our target companies

A typical INPODE portfolio is composed of 10-15 stocks that give it a high active share (typically close to 100%). This means that we do not merely reproduce our benchmarks: in other words we do not charge you for being “closet indexers”. We review each company in the portfolio, especially the quality of its management. As does Warren Buffett, we look for evidence of intelligence, energy and integrity in the managers of the companies that we partner with.

3. Post-investing review and reinvestment of cash

The portfolio manager INPODE works with reviews each stock in every portfolio monthly and, where appropriate, reinvests the cash that has been accumulating in clients’ accounts. The portfolio manager rarely sells the stocks in INPODE portfolios. Occasionally, however, firms in INPODE portfolios merge or are taken over. When this happens the portfolio manager reinvests the cash in the latest companies flagged by INPODE’s computerized screens or in those that have underperformed in order to “buy low”. This discipline enhances returns over time.

Ultimately, time and compounding will work their magic. INPODE’s software also checks statistically that the number of stocks in each INPODE portfolio reduces diversifiable risk (the avoidable risk any investor faces) as much as possible (we have investigated this in detail in an academic paper on this topic). Of course, market risk (undiversifiable risk) remains and cannot be avoided, but INPODE’s dividend-focused strategy means that investors can rely on cash flows from dividends from their portfolios, regardless of fluctuations in the market. Great companies remain great through ups and downs in their stock price. Staying the course through a long market downturn then becomes a psychological not a technical issue (read Ben Graham and Warren Buffett’s Mr. Market metaphor in Why INPODE?). We will help you understand market fluctuations and stay the course.